Why Your SIOP and Inventory Forecasts Fail Without Installed Base Data

We are heading to ConExpo Expo, Las Vegas (4th - 7th March). Let’s meet. Book a call here.

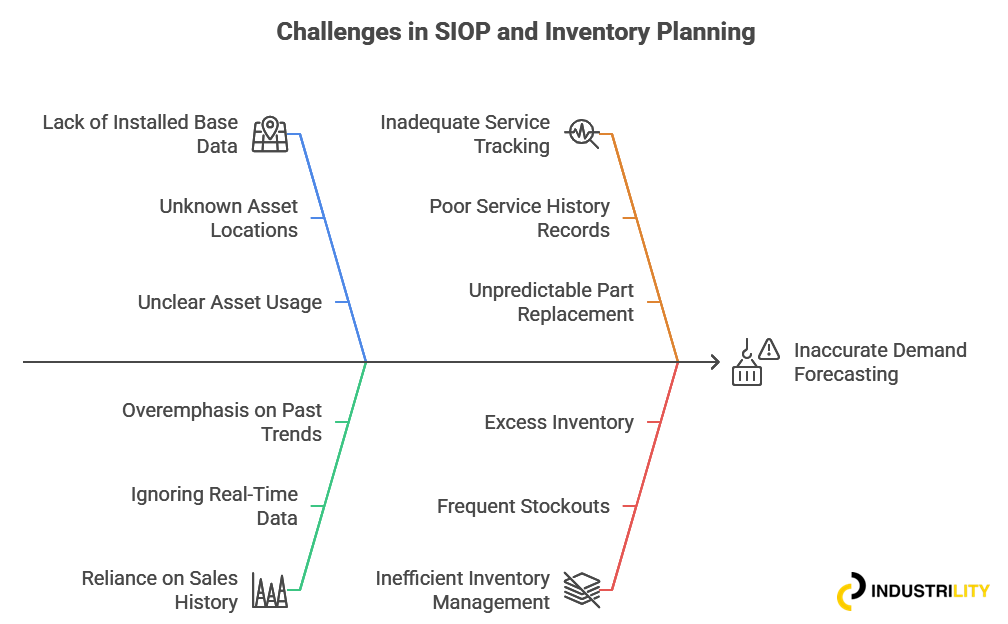

If you’re involved in SIOP, inventory planning, or service operations at an industrial OEM, you’ve probably faced one (or all) of these challenges:

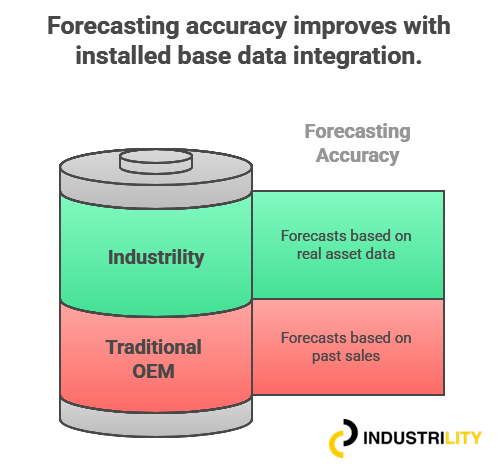

Because most OEMs forecast demand based on sales history—not on what’s actually happening with their installed base in the field.

Here’s the Fix:

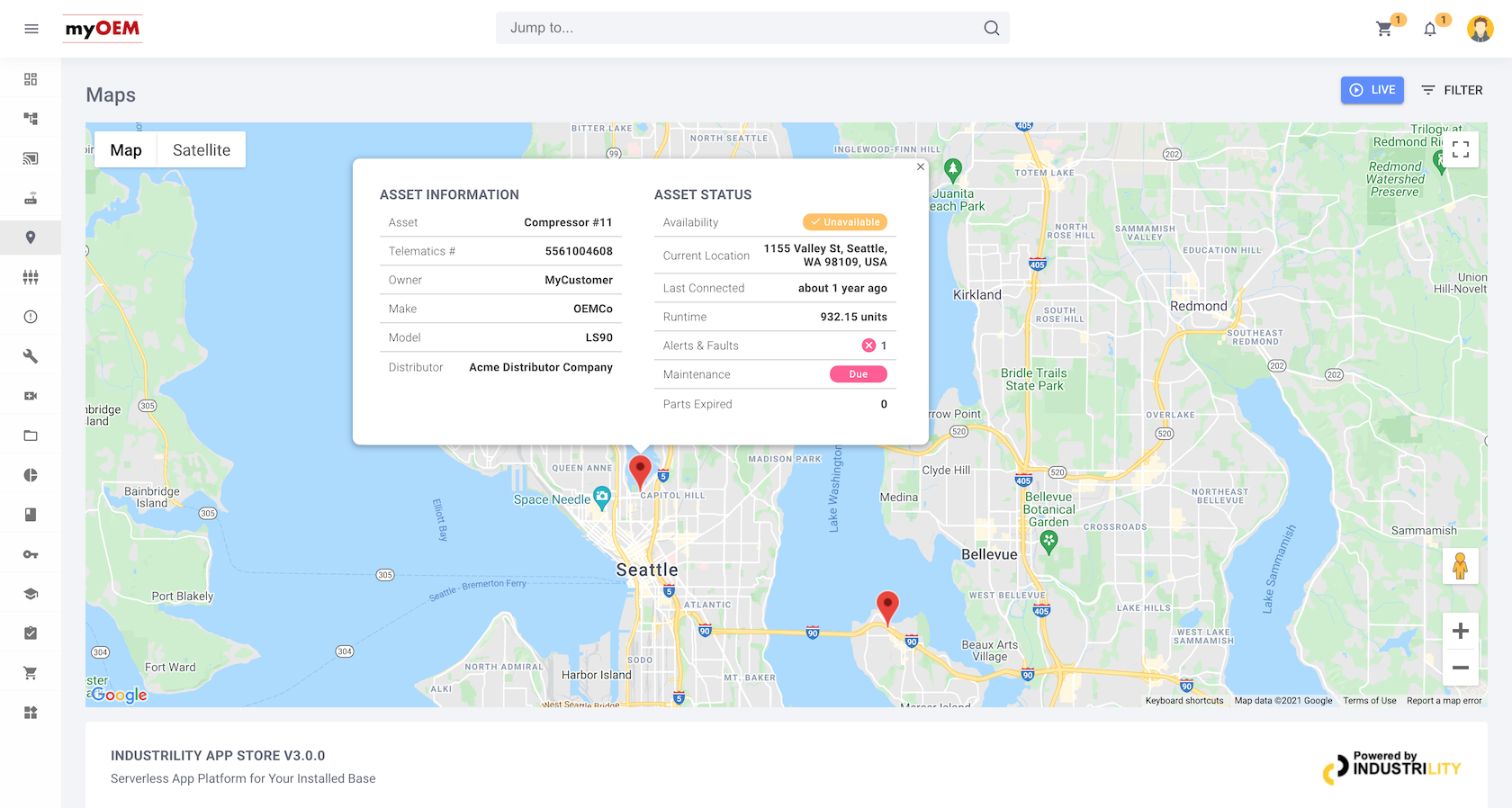

Industrility gives you asset-level visibility. That means:

For Private Equity Firms: If you’re acquiring OEMs, Industrility helps you quickly model the aftermarket TAM based on real installed base data.

Industrilty’s after-sales app platform and consulting services enables equipment manufacturers to launch, manage and scale their aftersales function, build a special customer link building a customer intimacy, improving superior customer satisfaction, better brand reputation; All of this without being a big and long IT project.

Industrial OEMs (Original Equipment Manufacturers) are sitting on a hidden revenue goldmine: their installed base of assets in the field. Yet, most lack visibility into where their products are, what condition they’re in, and what parts or services they will require next. This lack of Installed Base visibility leads to poor Sales, Inventory & Operations Planning (SIOP), inefficient aftermarket inventory management, and missed revenue opportunities.

Industrility’s Installed Base Management and Service Lifecycle Management (SLM) platform bridges this gap. By providing asset-centric insights, Industrility empowers OEMs, supply chain teams, and private equity investors to optimize aftermarket operations and capture untapped revenue.

The article explains how AI goes beyond simple document extraction by uncovering hidden maintenance tasks humans often miss. Using semantic understanding and cross-manual linking, AI builds a dynamic maintenance knowledge graph, improving accuracy, safety, uptime, and operational efficiency while transforming static manuals into continuously evolving maintenance intelligence.

Industrility’s Shopify integration helps manufacturers simplify B2B aftermarket sales. Create your online store, personalize orders, and grow your market reach.

AI is reshaping industrial manufacturing. Pat McCarthy shares key insights on driving digital transformation for OEMs and unlocking new growth.

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions. This data may be utilized, particularly for marketing purposes.